Have you ever wondered about the environmental impacts of building your wardrobe? Yes, apart from your daily commutes and lifestyle choices, how your beloved fashion pieces reach your wardrobe also impacts your overall carbon footprint.

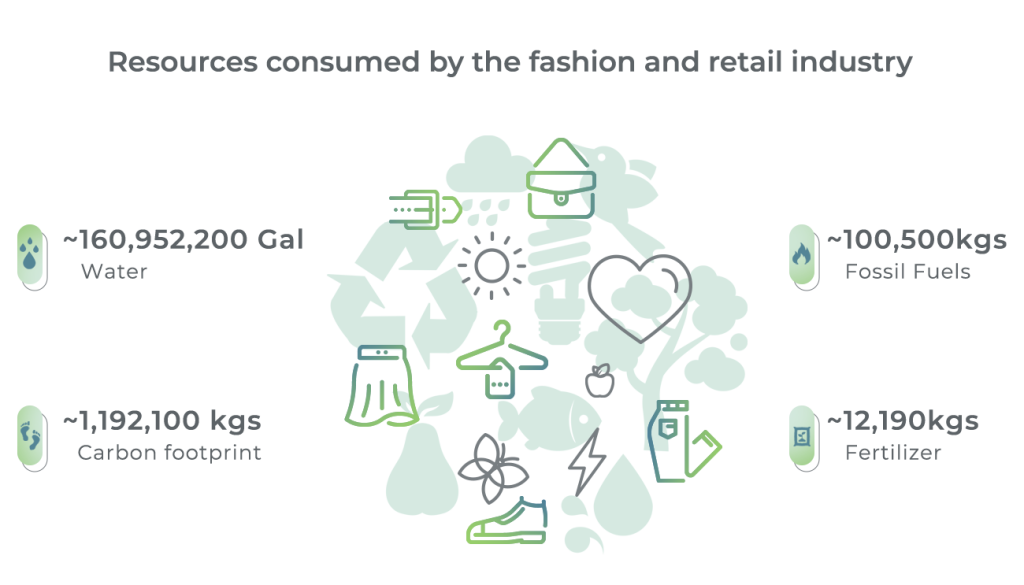

The fashion and retail industry is one of the largest consumers of natural resources like water, fossil fuels, fertilizers, etc. It’s also a major contributor to air, land, and soil pollution. As consumer awareness about sustainability is increasing, 67% of consumers report being more cautious of resource utilization owing to their scarcity. This has caused brands and retailers to step up to fulfill the ethical and societal obligations of their business practices.

Shifting to business strategies and practices that help brands and retailers meet the current demand while safeguarding and nurturing natural resources for the future is the need of the hour.

Sustainability in Fashion: A Road Less Travelled

The predicament of the fashion industry is unique: Maintaining a delicate balance between supplying customers with the latest in fashion and reducing the environmental impacts of the clothing’s lifecycle.

The retail system is inefficient due to overproduction and wastage of existing inventory. Matching supply with present and future demand is a complex task that is dependent on large volumes of legacy data.

In addition to sustainable sourcing, alternative materials, and selling to secondary markets, innovative use of technology can also have a significant impact. Retail tech is drastically improving how existing inventory is adequately utilized in the system.

A lot of these core problems can be solved during the buying and merchandising phase. Till now, the traditional methods have been unsuccessful leading to overbuying and overstocking. This creates a vicious cycle of abundant inventory getting sold at highly discounted prices before getting dumped in landfills or burnt on a large scale.

Retail Tech: Light at the End of the Tunnel

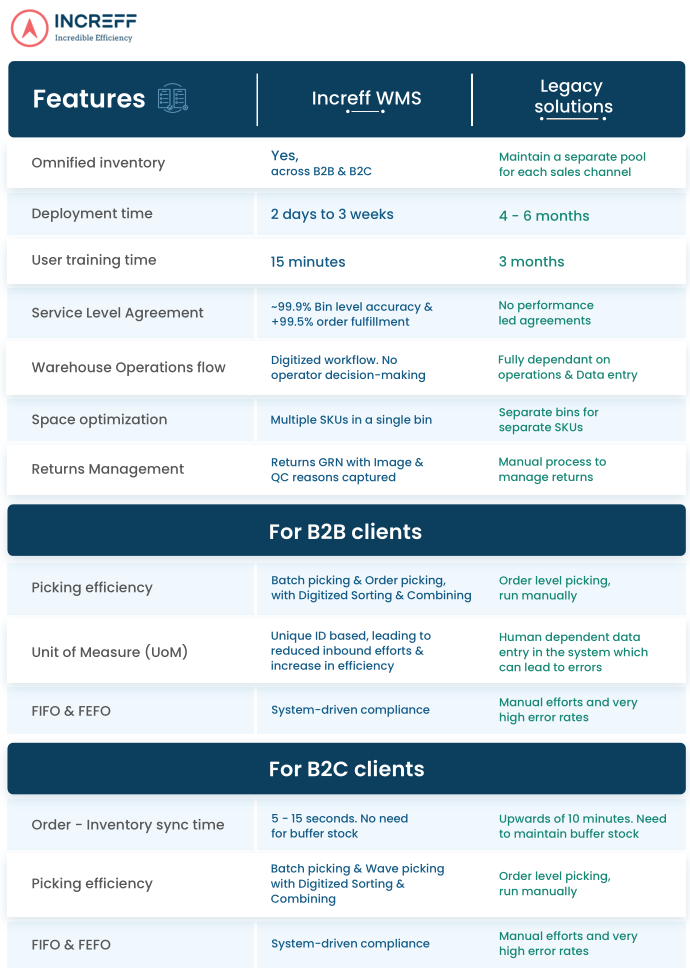

Retail tech is one of the most effective ways to build agility and sustainability into every aspect of their business. Particularly considering that this transformation combines online and offline channels.

Let’s take a look at how this gets done:

1. Sending the right inventory to the right warehouse: The guesswork of sending inventory to the right locations is eliminated by utilizing regional distribution.

It’s common knowledge that warehouses function with limited capacity. Once inventory reaches the warehouse, its efficient storage and redistribution become of utmost importance. Retail tech has made regional utilization a reality using which retailers and brands can optimally allocate inventory in proportion to the regional demand. In addition to reducing shipment time, this contributes to a more sustainable lifestyle by reducing fuel consumption and carbon footprints.

Increased visibility of in-stock inventory leads to higher conversion rates on marketplaces, faster deliveries, and a lower return rate for retailers and brands.

2. Simultaneous exposure of inventory both offline and online: Beyond the warehouse, how do you utilize inventory you have designated for online channels? Often times sales don’t go as predicted and retailers and brands are left with large quantities of unsold inventory. New-age retail tech solutions make it possible to expose offline inventory to online sales channels, thus allowing greater exposure and ensuring no inventory is left behind.

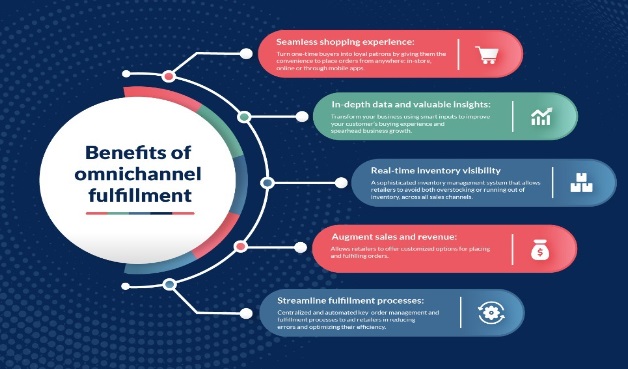

With Increff O2O (Online to Offline) or the store fulfillment solution exposes store inventory online and enables an omnichannel fulfillment ecosystem, thus preparing the stores for the future of retail. It allows automatic order routing and splitting to the closest store location, and enables manual store hopping in case the order is not available at the designated store. This ensures fulfillment from the nearest possible location in the most optimum way.

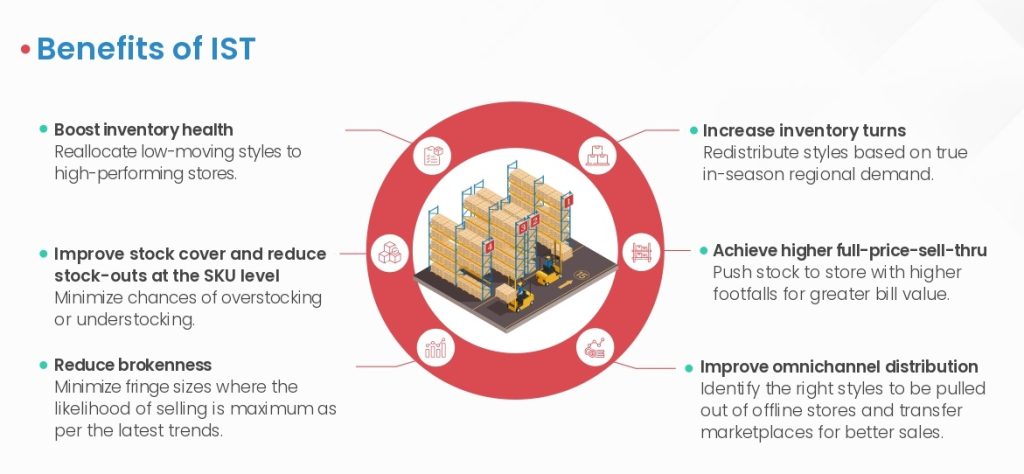

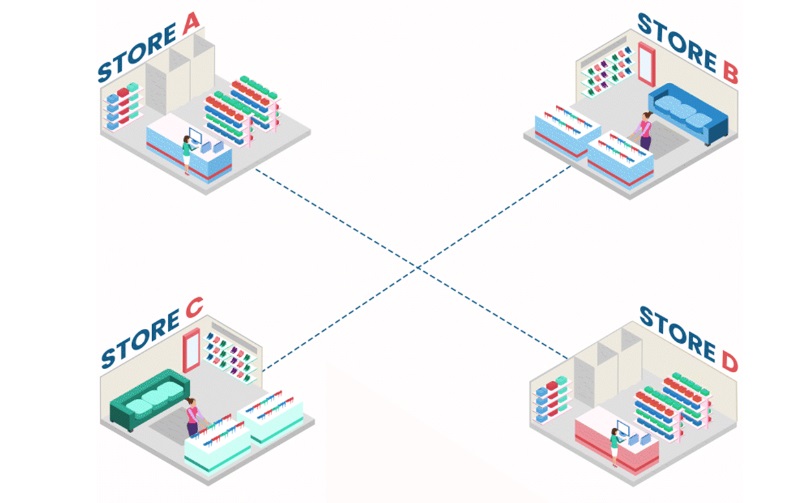

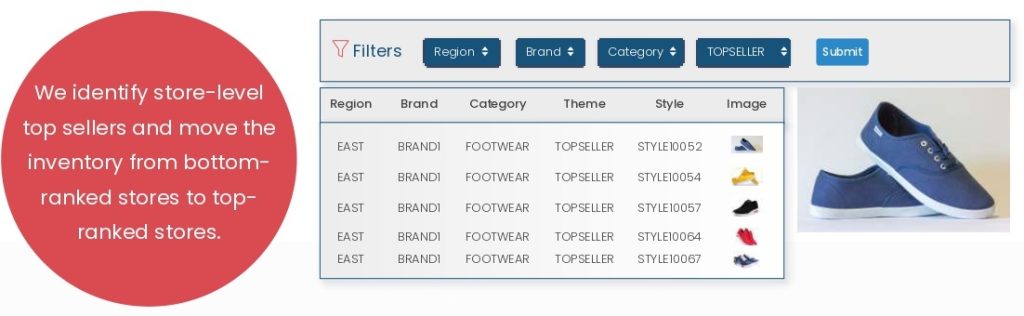

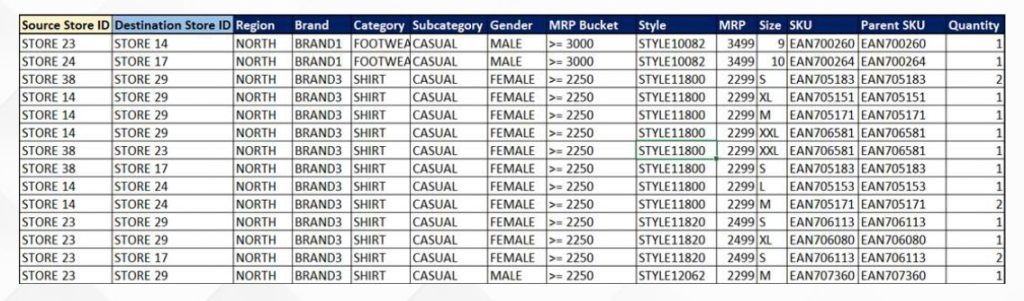

3. Move the right mix of products to the right store: Even with accurate pre-season demand forecasting, retailers and brands may experience situations where certain products are in demand in one location but are available in another during the in-season. No worries, retail technology can help you with this too.

Inter-store transfer feature helps prevent major inventories from going into liquidation. It is a part of merchandising where inventory is transferred between different store locations that belong to the same retailer for better exposure of inventory and subsequent improvement of sales. Through advancements in retail tech, it becomes a breeze to conduct analysis on a store style level, and inventory transfer is done from low-performance to high-performance stores.

4. Appropriate discounting before liquidation: Every retailer and brand knows the pain of liquidating the inventory left behind in the warehouse after the season ends. It is not only a waste of their money, but it also contributes to pollution – by rotting in landfills.

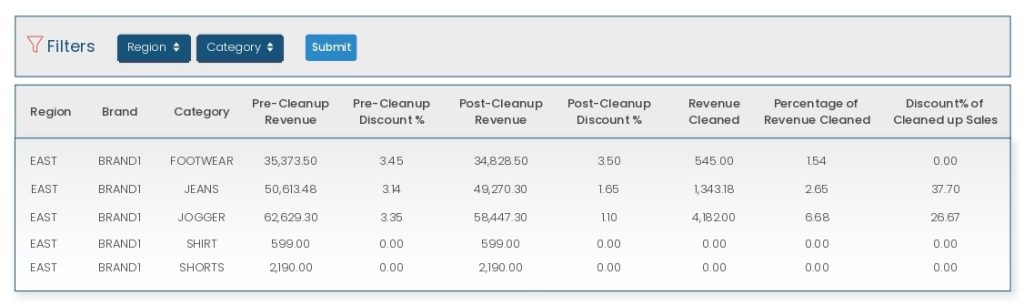

By using a markdown optimization tool, retailers and brands can offer appropriate discounts at the right time, keeping sales high. It uses an advanced, data-driven algorithm to analyze high-volume data to calculate a product’s optimal discount price which maximizes sell-through and minimizes sales loss due to pricing.

The Bottom Line

In the fast-moving world of fashion, sustainability, and technology are quickly becoming mutually inclusive. Retail tech will greatly help brands and retailers to data-driven decisions to avoid the overuse of resources and adopt more sustainable practices.

At the heart of Increff’s operations, lies the responsibility of simplifying the complexities in supply chain operations and inventory management. Contact us to learn more about our suite of intelligent, tech-driven retail solutions.