Sales are the lifeblood of a business. However, with the ever-increasing competition and changing consumer behavior, it can be challenging to drive increasing numbers and revenue. The rise of fast fashion and the boom of the e-commerce industry has also made it more difficult for clothing brands to stand out and attract customers.

A survey by Econsultancy reports that sales of fashion brands fell by 25% during the pandemic. And even after COVID-19 subsided, while online sales rose by £2.7 billion, the total sales dropped by £9.6 billion in 2021.

So, it is clear that the online fashion industry now has a significant impact on brands. And it is not as easy for companies to increase their sales without having a strong brand identity and online presence. Brands must also focus on their operational side of things like streamlining inventory management, optimizing allocation & distribution, and deploying a smart sales strategy to boost their sales.

In this blog post, we’ll explore some smart strategies to help clothing brands increase their sales and revenue.

1) Build a strong brand identity

The key to having a solid brand identity is ‘Consistency and storytelling.’ It is crucial to build an image your customers will recognize at a glance, whether online or in traditional brick-and-mortar stores. Your brand story should also align with the company’s values and mission and establish an emotional connection with the target audience. This leads to brand loyalty and an increase in sales.

When a brand builds a messaging that stays the same across multiple customer touch points and is visually unique, they are able to reinforce its identity multiple times. It also helps build a distinct identity that separates it from the competition. Forbes reports that companies that take their time building a consistent brand image across all their sales channels see up to a 23% increase in revenue.

Having hero products and building new stories around them is another great way to establish your brand identity. It often becomes synonymous with the brand, making it easily recognizable. For instance, the Hermès Birkin bag is one of the most recognized and coveted luxury handbags and has driven recognition for the brand globally. It can differentiate a brand in a crowded market by representing the unique value proposition of the brand and highlighting what sets them apart from competitors.

Additionally, since a hero product is often the top-selling product of a brand, it ties to sustainability and profitability. That’s because a brand doesn’t have to experiment and can count on its inventory of hero products always selling well and not ending up in landfills.

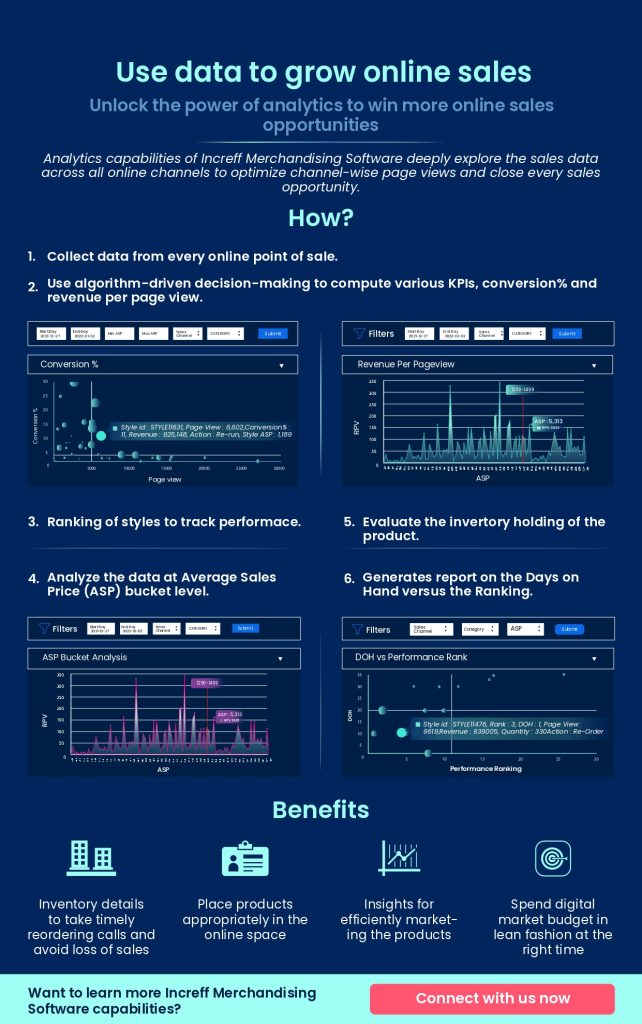

2) Re-strategize using past data

It is rightly said by Clive Humby that “Data is the new oil.” Brands can unlock a lot of growth potential by analyzing past sales information brands and identifying important sales patterns, trends, and customer preferences. That, combined with analysis of factors that contributed to high or low sales during a particular period, can help companies formulate their future sales strategy.

Data can also help segment the customer base based on age, demographics, preferences, and location. This information can help brands tailor their marketing messages and promotions to specific customer groups, increasing the likelihood of sales. Even McKinsey reports that brands that use data to offer a personalized customer experience see their digital sales jump by 30%-50%.

3) Streamline your inventory

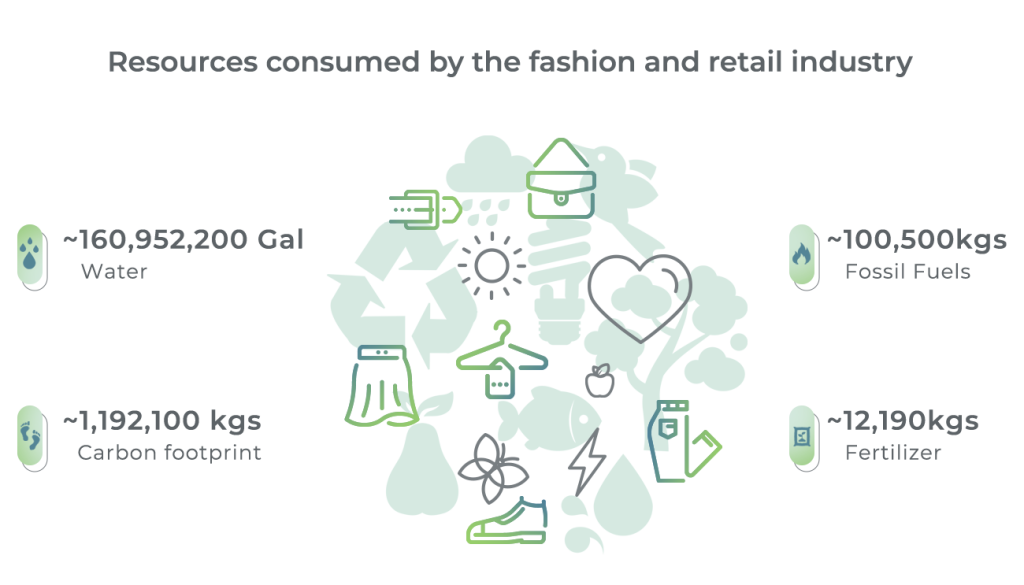

A report by The Ellen MacArthur Foundation suggests that the fashion industry is particularly prone to overstocking, with an estimated 30% of clothes produced never sold. This major operational cost for businesses can be reduced significantly with some key practices.

By managing inventory more efficiently, brands can reduce costs, minimize waste, and improve customer satisfaction. An effective buying and planning strategy that identifies the right inventory mix and assortment for stores and online channels is vital. It helps prevent situations like out-of-stock items, low fulfillment rates, and poor customer satisfaction.

The idea here is to double down on the demand potential and not let interested customers go away without buying. It can be done by accurately predicting the true size ratios at the right granularity to understand which products you need in your inventory and in what quantity. You wouldn’t want to run out of your best-seller during peak sales, Right?

4) Optimize allocation and replenishment

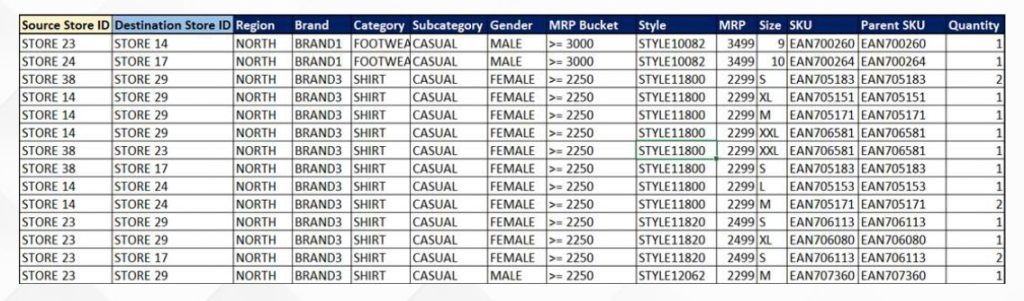

Once you streamline your inventory, the next step is to optimize allocation and replenishment. This involves determining which items are selling well at which locations and then using that information to allocate inventory to the right stores at the right time. By maintaining the optimum depth for SKUs at each store based on the true rate of sales (ROS), brands can ensure the right inventory distribution.

You need to regularly analyze store-level sales data to identify best-selling items, underperforming products, and sales trends. Then, use this information to make informed decisions about product allocations and replenishments.

One key strategy for optimizing allocation and replenishment is using automated systems. They can help you ensure that your stores always have the right amount of inventory to meet demand without overstocking and risking excess waste. By automating the allocation and replenishment process, you can also reduce the time and effort required to manage inventory, allowing your team to focus on other essential tasks.

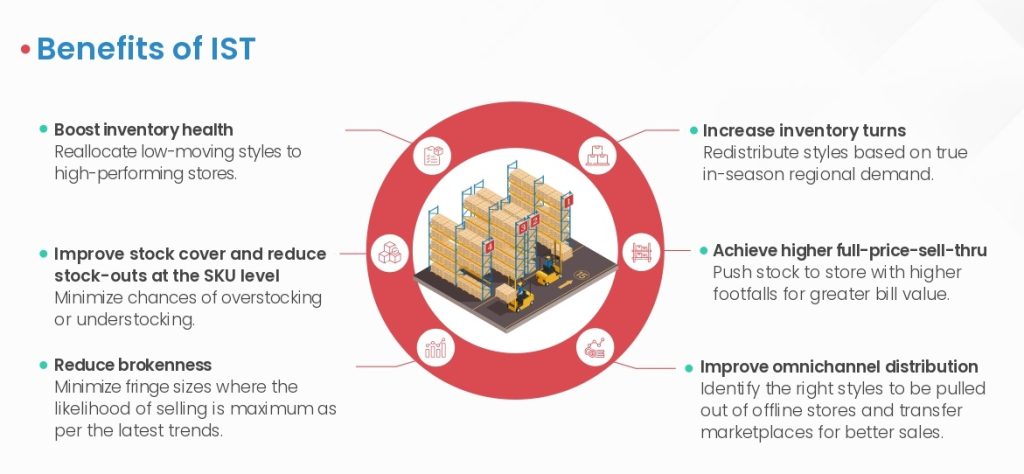

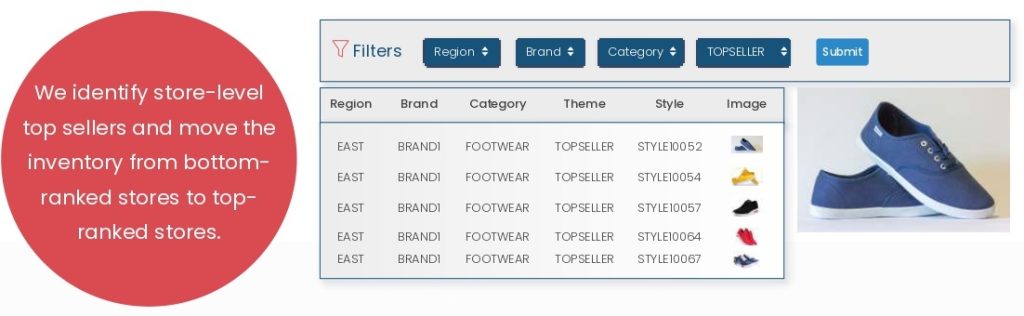

5) Inter-store and warehouse transfers

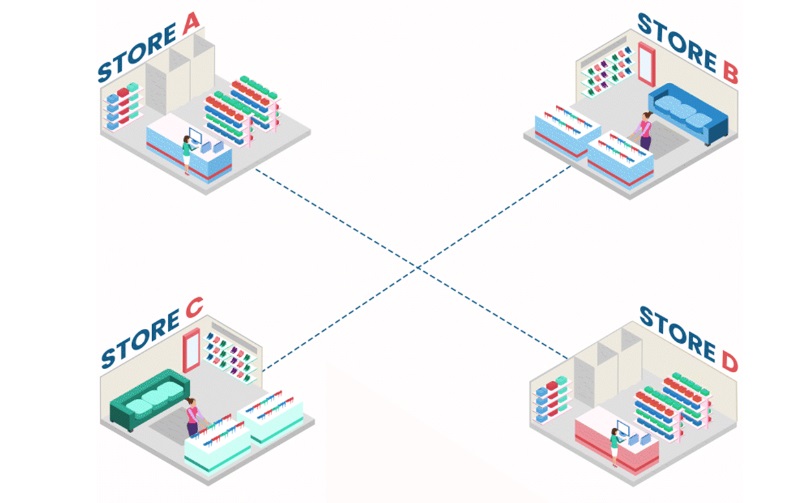

Transferring stock between stores or warehouses ensures that each location has sufficient and balanced inventory levels. This prevents stock-outs and overstocking, which can negatively impact sales. It also helps reduce the brokenness of products by consolidating size sets in one store location with the highest likelihood of making the sale.

When a brand has a chain of stores, it is obvious that not all of them will have equal footfall. This is where inter-store transfers can help by ensuring that high-performing stores do not run out of inventory while low-performing ones aren’t overstocked. It also helps brands consolidate all inventory at a regional level to have healthy stocks at the right stores to give the inventory a final chance to sell before the end of the season sale.

Inter-warehouse transfers also work similarly, taking into account regional demand. For example, if a brand’s south India warehouse is running out of festive wear during Pongal, it can transfer inventory from its northern warehouse to match the demand. It helps prevent inventory from lying around in warehouses where there is no demand, reducing the need for markdown to clear stock. At the same time, warehouses can move stocks based on regional demand to improve delivery speeds and reduce costs.

6) Implement a smart sales strategy

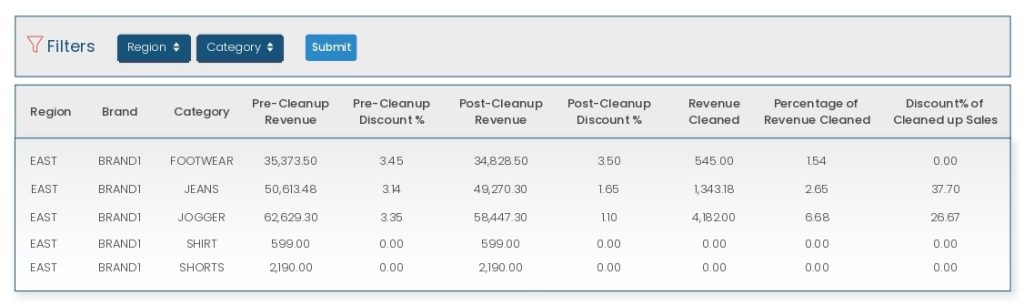

Most brands need a more proactive approach to discounting. They do not analyze demand in real-time to adjust their price accordingly, which results in higher price cuts during the off-season. This results in missed sales opportunities and losses that fashion brands find difficult to circumvent.

This problem can be overcome by implementing a smart sales strategy where the discount on the product will be increased or decreased by analyzing the style’s ongoing performance and stock status. For example, if you see a product is not doing particularly well at 10% off, the discount rate can be increased to 20% to clear the inventory. It is far better than selling the same product for a 40%-50% discount at the end of the season.

Brands must plan ahead by considering product lifecycle, seasonality, and upcoming sales events. This can help them manage inventory more effectively and reduce the need for last-minute, deep markdowns.

Increase your revenue by 20-25% with Increff

Increff’s Merchandising Software employs advanced data analytics to provide actionable insights into your sales, customer behavior, and inventory. This enables precise decision-making in areas like product selection, pricing, and promotion, helping you maximize sales and revenue by up to 25%.

With Increff, you can manage your inventory more effectively, ensuring you have the right products in the right place at the right time. This reduces stock-outs and overstocks, increases sales, and reduces costs. A leading menswear brand has seen a 40% increase in sales for their consolidated inventory via IST.

Additionally, our markdown optimization tool helps you strategically reduce prices on slow-moving items, further boosting sales.

With Increff, you’re not just adopting a technology solution – you’re partnering with a team of retail experts dedicated to helping you achieve your business goals. By leveraging our merchandising solution, you can expect to see a significant increase in your revenue, positioning your business for long-term success in a competitive retail landscape.